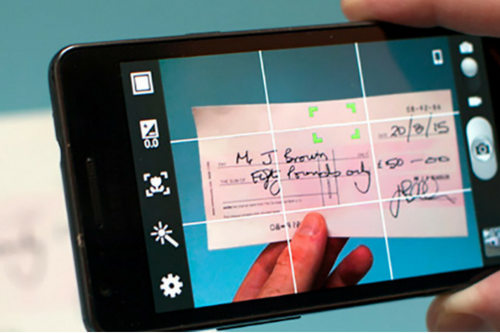

The rise of digital technology has dramatically altered the landscape in the financial-services sector. Banks offer financial planning and trading applications through smartphones and social media; cloud technologies are widely accepted, and in many cases robotics are already reducing cost and increasing quality. Since 2011, the number of startups in fintech (technology-based companies that often compete against traditional financial-services, or FS, firms) has risen more than 50 percent.

All this activity has provided new opportunities (and new competitive threats) for the industry. There is thus a significantly higher premium on the performance of the IT teams in FS institutions. To meet the demands of the new marketplace — to offer competitive, feature-laden, well-designed digital products and services, with a much faster speed-to-market, while lowering costs and continuing to support legacy systems — an IT function has to be flexible, efficient, and responsive. But those adjectives are not always applied to conventional IT departments. Many financial-services firms will have to do much more than merely reexamine their go-to-market strategies; they must also dispassionately reassess their IT operating model, and be prepared to jettison the approaches they have used for decades.

Want to know more about digital marketing training or code training for you or your organisation?