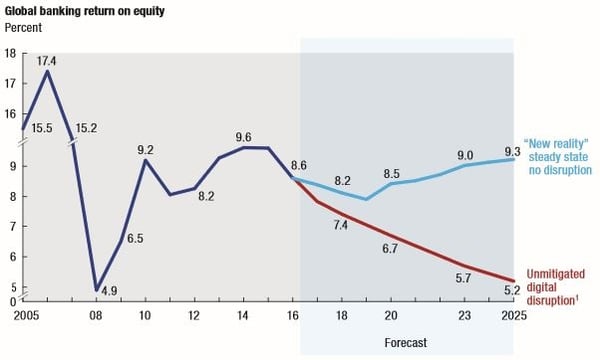

The global banking industry shows many signs of renewed health. The recovery from the financial crisis is complete, capital stocks have been replenished, and banks have taken an axe to costs. Yet profits remain elusive. For the seventh consecutive year, the industry’s return on equity (ROE) is stuck in a narrowly defined range, between 8 percent and the 10 percent figure that most consider the industry’s cost of equity. At 8.6 percent for 2016, ROE was down a full percentage point from 2015. Further, banks’ shares are trading at low multiples, suggesting that investors have concerns about future profitability. Several regions and business lines have done better, and some institutions are outperforming due to strategic clarity and relentless execution on both their core businesses and their efforts to improve.

In the 2017 edition of the McKinsey Global Banking Annual Review, new research suggests why performance is trending sideways and how banks can change it for the better. Key findings include:

- The variations in banks’ valuations continue to be substantial, but the reasons for the variation have shifted dramatically. In 2010, 74 percent of the difference in valuations was due to geography: banks with operations in hot markets were valued more highly. In 2017, geography accounts for just 39 percent of the difference. The rest is due to the business model and its execution, strategy, well-aligned initiatives, and the other levers that banks command.

- In our 2015 review, we estimated the impact of the digital threat. In this report, we update the estimate to account for a faster pace than we anticipated. As interest rates recover and other tailwinds come into play, the industry’s ROE could reach 9.3 percent in 2025. But if retail and corporate customers switch their banking to digital companies at the same rate that people have adopted new technologies in the past, the industry’s ROE, absent any mitigating actions, could fall by roughly 4 points, to 5.2 percent by 2025.

- Banks cannot afford to wait any longer to extract the potential of digital to industrialize their operations. As an essential first step, banks that have not yet fully digitized must explore the new tools at their disposal and build the skills in digital marketing and analytics that they need in order to compete effectively. If most of the industry were to do this, and not compete too much of it away, we estimate that banks would add about $350 billion to their collective bottom line.

This gain from digitization would lift the average bank’s ROE by about 2.5 percentage points — not enough to fully offset the 4-point drop. But no bank can afford to forego the benefits of digital, and individual banks can do much better than the average. A full-scale digital transformation is essential, not only for the economic benefits, but also because it will earn banks the right to participate in the next phase of digital banking.

“Platform” companies such as Alibaba, Amazon and Tencent are reshaping one industry after another, blurring sector boundaries as they seek to be all things to all people. If this integrated economy begins to emerge in a bank’s market, it could be an opportunity for those banks that have built digital skills and rapid reflexes. Banks that successfully orchestrate a basic “ecosystem” strategy, by building partnerships and monetizing data, could raise their ROE to about 9 to 10 percent. Banks that can go further and create their own platforms might capture a small share of some non-banking markets, which would elevate their ROE to about 14 percent — far above the current industry average.

The ecosystem strategy is not open to every bank; nor is it the only option. Banks could also find success, though less profit, with two other business models: a white-label balance sheet operator, or a focused or specialized bank. But should the integrated economy develop in the way that many expect, a successful ecosystem strategy could be the key to a bright digital future for a number of banks.

Regardless of a bank’s views on the ecosystem economy, a comprehensive digital transformation is a clear “no-regrets” move to prepare for a digital and data-driven world. As banks move from their traditional focus on products and sales to customer-centric marketing, they should re-confirm that their source of distinctiveness is still potent, design and deliver an extraordinary customer experience, and build the digital capabilities needed not just for the next few years, but for the longer term. With those assets in hand, banks will be ready when the ecosystem economy arrives.

*Read the full report here.....

Would you like to ‘talk’ to me about the above 7 Opportunities for Banks to Generate $350bn? Or anything else I can help you with? Then please do reach out to me….

Want to know more about digital marketing training or code training for you or your organisation?